Where money moves, crime evolves. As banking becomes fully digital—with instant payments, open finance APIs, and mobile-first onboarding—it has opened new roads for cyberattacks, forcing financial institutions to respond in real-time. With just seconds to detect, prevent, and react to suspicious activity—without disrupting the customer experience—banks face an immense challenge that only modern, AI-powered solutions can meet.

Welcome to our new series on mitigating financial crime with MongoDB. In the Financial Crime Mitigation series (this is the first of five posts we have planned!), you will learn how to build modern, anti-fincrime platforms that keep pace with increasingly automated, AI-assisted adversaries.

Let’s begin by understanding what financial crime is and why it matters.

A trillion-dollar problem

Financial crime encompasses illicit activities that exploit the financial system, from sophisticated money laundering schemes to AI-powered synthetic identity fraud. The numbers are staggering. According to the Global Financial and Economic Crime Outlook, global financial institutions' losses could reach over $2 trillion USD due to financial crime each year. Putting this in perspective, these losses may represent 3.5% of global GDP, with an expectation of having this figure nearly double to $6 trillion by 2030.*

But financial crime doesn’t just cause monetary losses. It also undermines customer trust, harms brand reputation, disrupts operations, and diminishes conversion rates. For all financial institutions, regulatory compliance demands a full-time dedicated team (led by a Chief Compliance Officer) for managing activities like investigating false positives, filing suspicious activity reports, and managing regulatory oversight, all of these subject to an optimized automation by using emerging technologies around AI.

This is why most leading financial organizations around the globe have launched financial crime prevention programs, working toward:

Enhanced security by having proper data governance and policies in place (particularly for digital banking services). With financial services now fully digitized, a strong digital security framework must be implemented to remain resilient from cyberattacks.

Transparency & Traceability. Adopting AI for critical decision-making processes implies incorporating explainability by design. Full disclosure is a requirement for dealing with intensifying regulatory pressure in favor of transparent, fair operations.

Immediacy. Real-time banking services demand running anti-fraud controls in the moment, which in turn requires high-processing capabilities for correlating all the relevant data points. All of these are feasible only with AI-powered high-level automation—in conjunction with data services provided by platforms like MongoDB Atlas.

Modernizing outdated legacy architecture. Traditional systems were designed based on a “single transaction” principle. Modern cyberattacks require a contextual analysis that requires combining transactional information with a massive inflow of unstructured data.

This last aspect is the most critical one. Let’s dive into the details.

The challenge: Legacy systems can't keep up

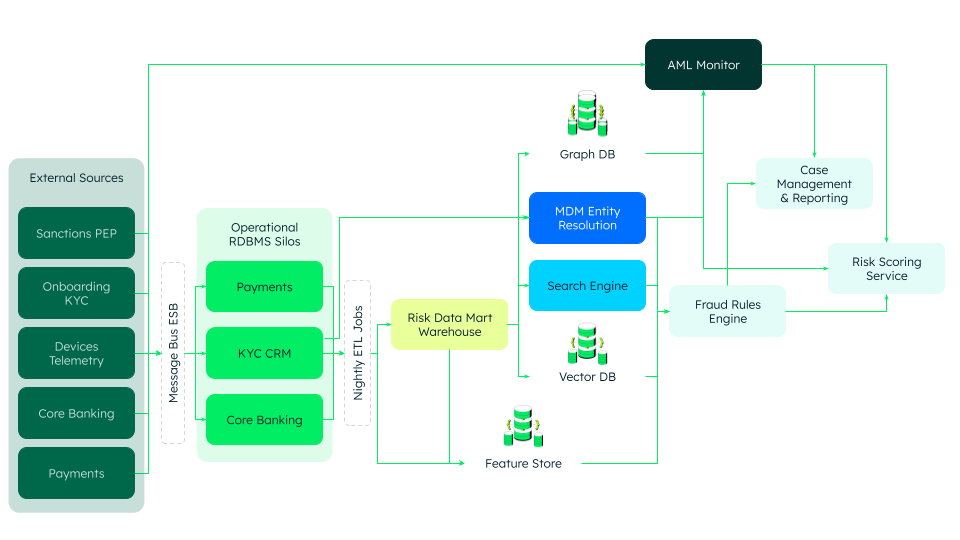

Traditional fraud and anti-money laundering (AML) systems were built for a simpler era. They are fragmented, rigid, and reactive, proving inadequate against today's adaptive, network-based criminal enterprises.

When these legacy systems attempt to manage modern threats, several challenges arise:

Disparate data silos: Customer data lives scattered across separate systems: core banking platforms, card processors, KYC systems, and CRM tools. Since each one uses its own schema, it creates integration nightmares and produces blind spots that criminals exploit.

Batch processing delays: End-of-day ETL processes move data into warehouses for analytics and rule tuning. By the time insights emerge, fraudulent transactions have already been cleared and settled.

Siloed detection tools: Separate engines handle transaction fraud, AML monitoring, KYC/customer due diligence (CDD), and case management. The problem is that little context flows between them, leading to duplicate data, conflicting logic, and missed connections.

Transaction-by-transaction myopia: Rules evaluate individual events in isolation, missing broader behavioral patterns and network relationships. Complex joins across multiple tables are slow, expensive, and error-prone.

False positive fatigue: Legacy systems generate up to 90% or more false positives**, overwhelming compliance teams and causing real threats to slip through. Without holistic entity views, they miss sophisticated, multi-party schemes.

Organizational Resistance to Change: Organizations often face resistance to change due to entrenched silos, with AML teams focused on compliance and fraud teams operating in real-time, creating cultural divides that technology alone cannot resolve.

The solution: A unified modern anti-financial crime platform

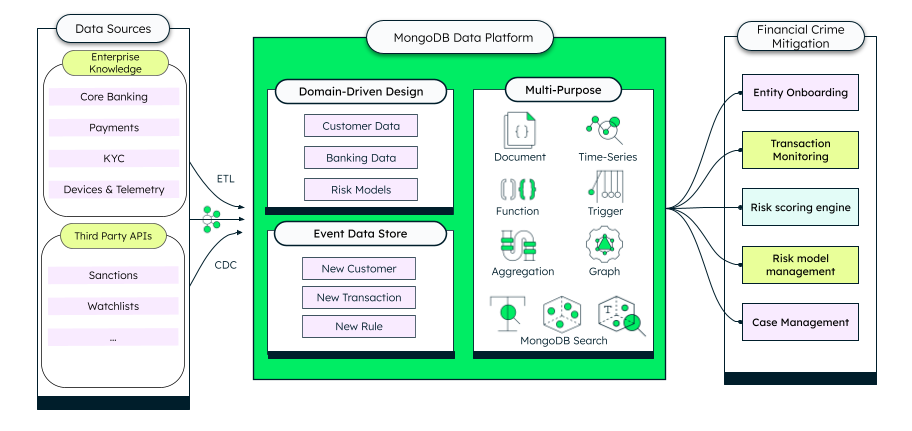

To overcome all these challenges, organizations require a fundamentally different approach: modern anti-financial crime platforms. Successful platforms that consolidate operational processing, search, entity resolution, and network analysis on a single, flexible data foundation.

Platform architecture: five integrated modules

MongoDB Atlas enables this unified approach through several key capabilities:

- Entity management and resolution

Organizations can power AI-driven entity resolution and duplicate detection using Atlas Search's $rankFusion to combine fuzzy text matching with semantic vector search. Perform network analysis directly in the database using the Aggregation Framework's $graphLookup to uncover hidden money laundering and fraud rings. - Advanced transaction monitoring

Blend traditional rule-based screening with Atlas Vector Search for semantic pattern matching. Identify suspicious behaviors that resemble known fraud patterns even when they don't match explicit rules. Evaluate transactions against both static rules and learned behavioral baselines in unified pipelines. - Behavioral risk scoring engine

Calculate risk scores via high-performance APIs that pull features directly from MongoDB. Support multiple model versions—rules, thresholds, feature weights—and switch between them instantly by updating an "active" pointer. All scoring services reflect new models immediately without downtime. - Risk model management

Enable fraud teams to create, edit, and version risk models dynamically. Use Change Streams to propagate real-time updates when new model versions activate, allowing rapid adaptation to emerging threat patterns without system restarts. - Case management and regulatory reporting

Triage alerts with full entity and network context. Support investigative workflows that surface related entities, transactions, and historical patterns. Generate regulatory reports like suspicious activity reports (SARs) with complete audit trails and automated filing capabilities.

Why MongoDB for anti-financial crime platforms?

Customer 360 foundation

With MongoDB's flexible document model, you can build a comprehensive, entity-centric view of customers, accounts, instruments, transactions, devices, and relationships. Store entities, events, and relationships in natural document structures—eliminating complex joins and data duplication across operations, search, vector analysis, and network investigations.

Real-time intelligence

Capture transactions and update them instantly as they occur using MongoDB’s Change Streams and Time Series Collections. Compute features, calculate aggregates, and assess risk with complete entity and network context at the moment of decision—enabling immediate action instead of retrospective analysis.

Hybrid detection approaches

Combine traditional rules with statistical models, graph pattern analysis, fuzzy search, and vector similarity in a single system. Run built-in analytics directly on your data to catch either known attack patterns or emerging threats without shuttling information between specialized tools.

Security and governance

Encrypt sensitive data at the field level while isolating workloads and maintaining a single source of truth. Track every change with comprehensive audit trails and version control to meet regulatory compliance requirements.

Run MongoDB anywhere

MongoDB offers flexible deployment options to suit your business needs. Choose MongoDB Atlas for a fully managed, multi-cloud environment, or deploy self-managed MongoDB Enterprise Advanced in private cloud or on-premises settings for a hybrid deployment architecture.

Building for competitive advantage

Having gained a better understanding of the “art of possible” to replace traditional systems with modern anti-fincrime platforms, the question then becomes: what is the most convenient approach for companies to address these issues: buying an off-the-shelf solution or building one in-house with MongoDB?

Buying: commercial solutions promise quick deployment but often constrain flexibility and may not integrate well with existing systems. More importantly, fraud and AML patterns are unique to each business model, customer base, and geographic footprint—making generic solutions less effective over time. Licensed solutions can also become expensive through customization costs, integration fees, and ongoing maintenance.

Building: custom platforms on MongoDB offers strategic advantages: rapid iteration of detection typologies, freedom from vendor constraints, and seamless integration of third-party signals like device fingerprinting and behavioral biometrics. Teams can leverage MongoDB's managed capabilities to focus on detection logic rather than infrastructure complexity. The build approach enables organizations to create platforms that evolve with their specific risk profiles and business needs, ultimately providing stronger protection and competitive differentiation in financial crime prevention.

The real “paradigm shift”

The paradigm shift isn’t just about faster tech; it’s about rethinking how we represent and act on data. Customers and their networks should be modeled as entities and events, not scattered across dozens of joined tables. Risk needs to be detected in real time, as business flows, not tomorrow in a batch report. A single, unified platform should power search, semantic similarity, graph reasoning, rules, and machine learning side by side, instead of relying on point solutions. And intelligence must be adaptive—models that ship, measure, and iterate in hours, not quarters, all without downtime.

Ready to modernize your approach to financial crime? Follow this series to see how a unified anti-fincrime platform with MongoDB can help you move beyond legacy approaches and build future-ready defenses against fraud and AML.

Stay tuned

In the upcoming blogs, we'll dive deep into each platform component:

- Entity Resolution for KYC: Create a true single view of your customers with behavioral analysis

- Real-Time Fraud Detection: Catch suspicious transactions instantly using vector search and change streams

- AML Risk Scoring with Graph Analytics: Spot hidden money laundering networks and complex relationships

- Agentic AI for Due Diligence: Empower risk analysts with LLMs and AI copilots for smarter, faster investigations

Next Steps

Check out these resources to strengthen your technical knowledge skills to build an anti-fin-crime platform:

Short-course “Introduction to AI and Vector Search”

AI Agents with MongoDB skill badge

Using MongoDB As Graph Database: Use Cases

References

*Global Financial and Economic Crime Outlook 2025

**The investigator-centered approach to financial crime: Doing what matters